Technical Analysis (14 AUG)

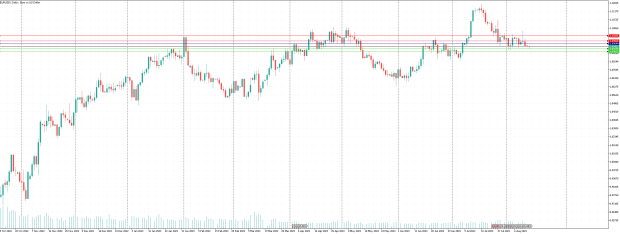

Euro – US Dollar

EUR/USD prints a two-day losing streak while falling to the fresh one-week low of around 1.0930. The Euro pair extends the previous week’s U-turn from the support-turned-resistance line stretched from late May towards breaking a short-term key support line and the 100-DMA.

If trading above 1.09644 is traded, the growth will likely continue to 1.09860.

On the other hand, if it trades below the range of 1.09644, the decline is likely to continue to 1.09239.

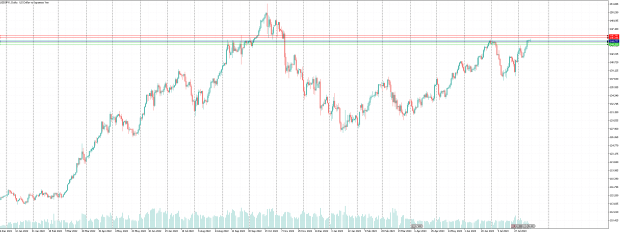

US Dollar – Japanese Yen

USD/JPY bulls take a breather at the highest level in a year as market players seek more clues to defend the Yen pair’s early-day run-up towards refreshing the Year-To-Date (YTD) peak amid the initial hour of Monday’s European session.

If the pair continues to trade above the range of 144.777 It is likely to continue climbing to 145.396.

On the other hand, if the pair is traded below 144.777, it is expected to continue falling to 144.583.

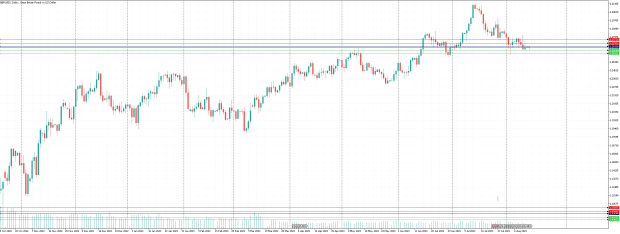

British Pound – US Dollar

The GBP/USD pair remains under pressure and trades in negative territory for the fourth consecutive week. The upbeat UK data fails to lift the Pound Sterling as investors are concerned about the possibility of a further rate hike that would impact the UK economy.

If the pair is trading above 1.26990 it is expected to climb to the range of 1.27323.

On the other hand, if the pair trades below 1.26990 it is expected to fall to the range 1.26594.

US Dollar – Swiss Franc

The USD/CHF pair remains range-bound around 0.8770 during the early Asian session on Monday. Meanwhile, the US Dollar Index (DXY), a measure of the value of USD against six other major currencies, extends its upside just below 103.00 and traded on a weekly positive note for four weeks in a row.

If the pair is trading above 0.87587 it is expected to climb to the range of 0.88057.

On the other hand, if the pair trades below 0.87587 it is expected to fall to the range of 0.87368.

Gold – US Dollar

Gold enters a bearish consolidation phase and seesaws between tepid gains/minor losses just above the $1,910 level, or the lowest since July 7 touched during the Asian session. The fundamental backdrop seems tilted in favor of bearish traders.

If the pair is trading above 1915.44 It is expected to climb to the 1918.98 range.

on the other hand, if the pair trades below 1915.44 It is expected to fall to the range of 1906.40