Technical Analysis (15 AUG)

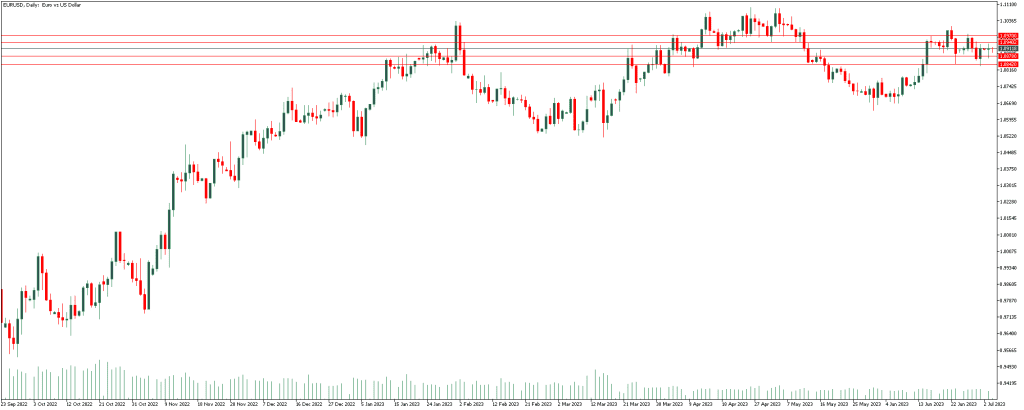

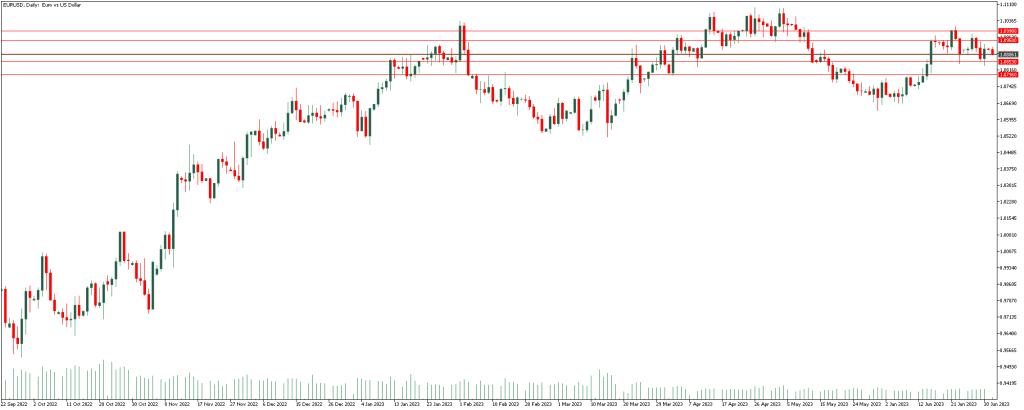

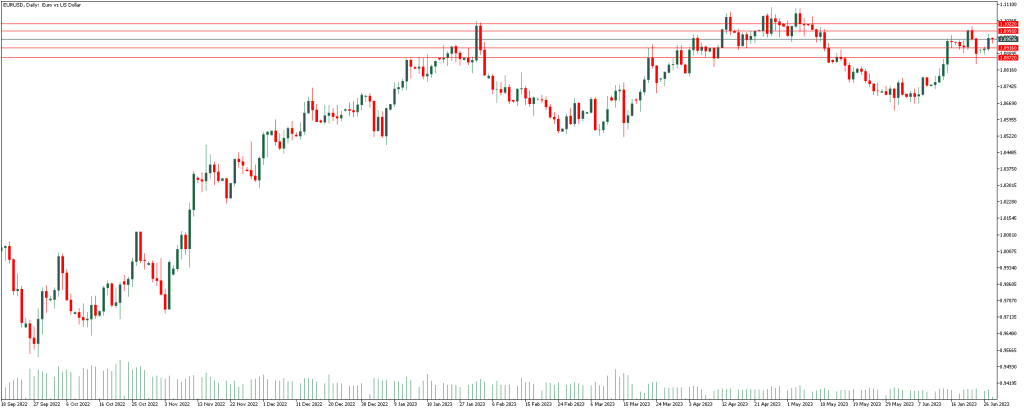

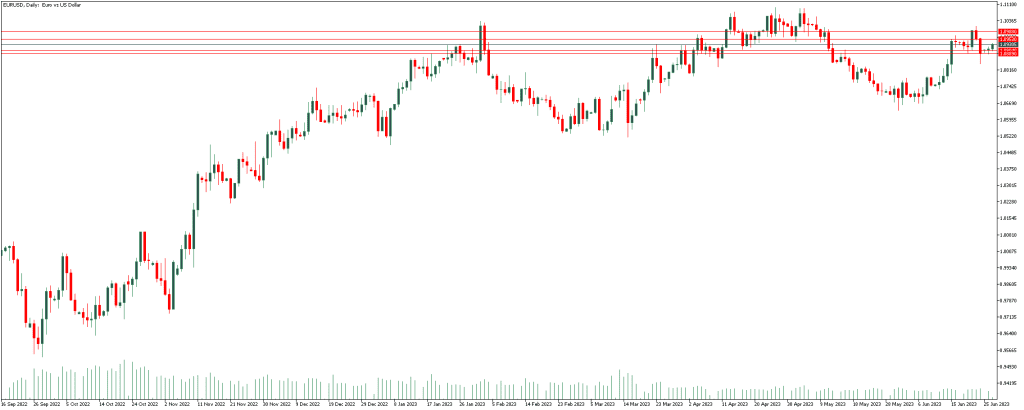

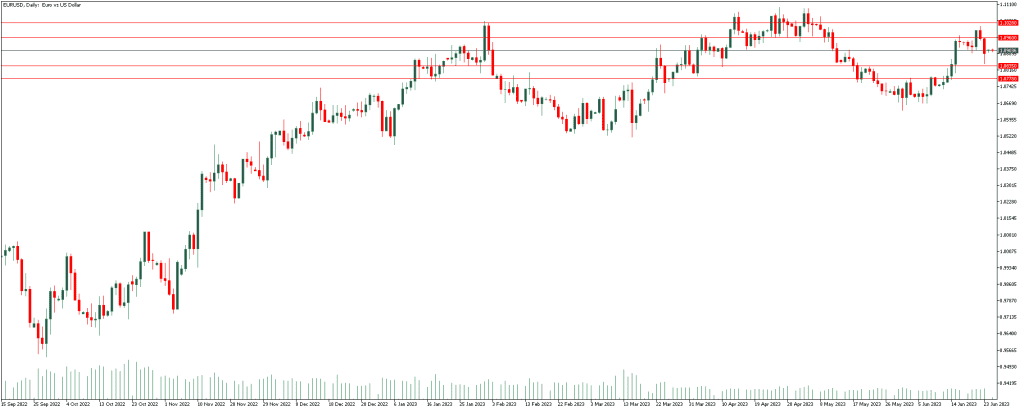

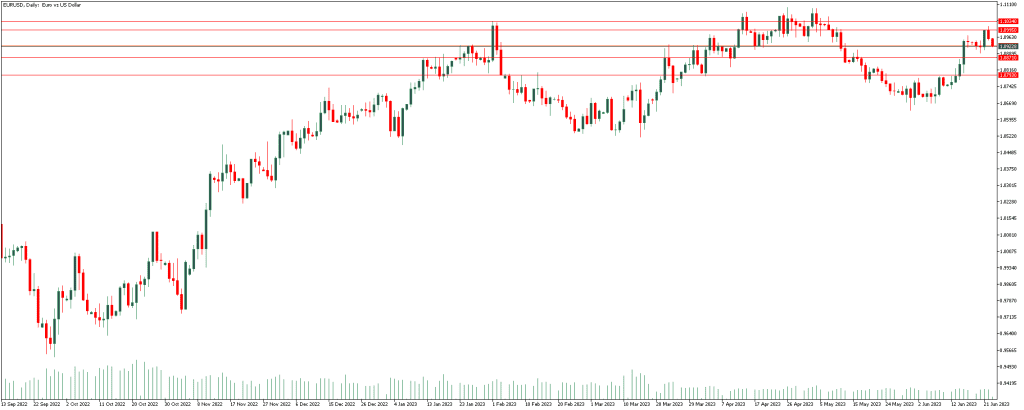

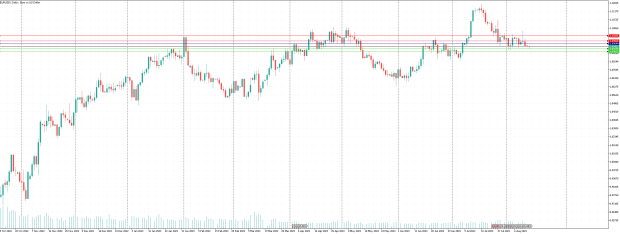

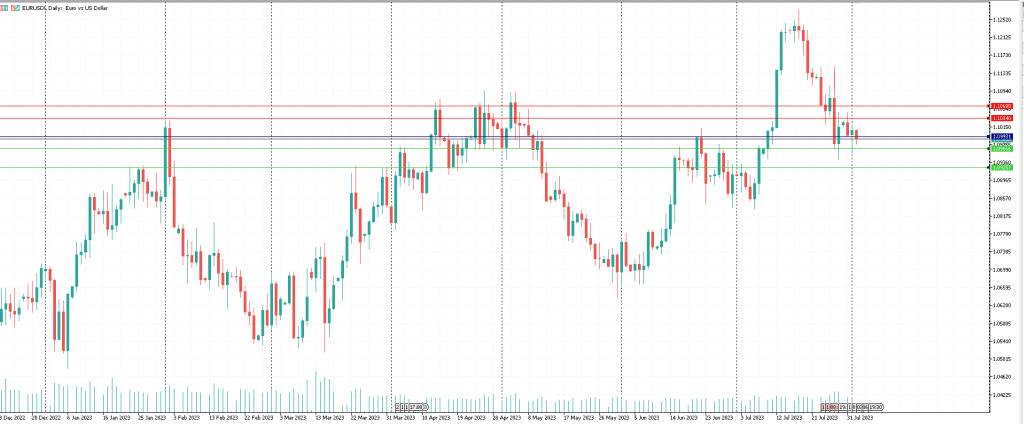

Euro – US Dollar

EUR/USD is easing toward 1.0900, stalling the previous recovery in the early European morning on Thursday. The US Dollar finds its feet, as markets turn cautious ahead of key inflation data releases from the Eurozone and the US.

If trading above 1.09096 is traded, the growth will likely continue to 1.09642.

On the other hand, if it trades below the range of 1.09096, the decline is likely to continue to 1.08201.

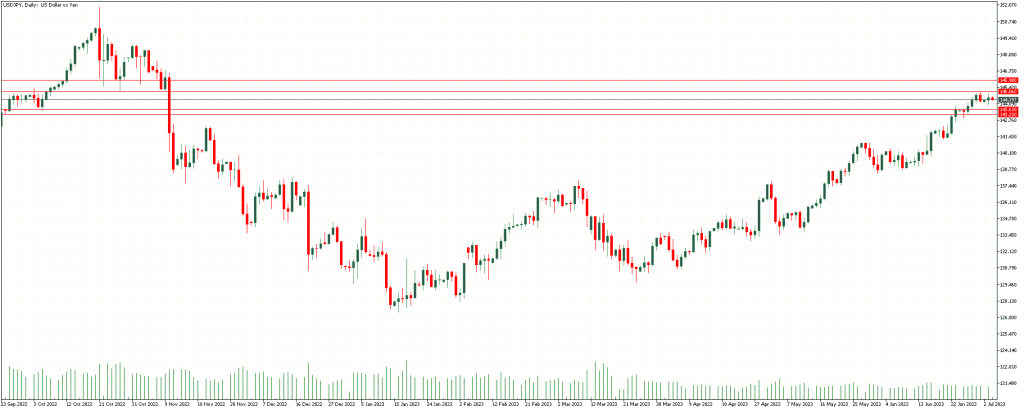

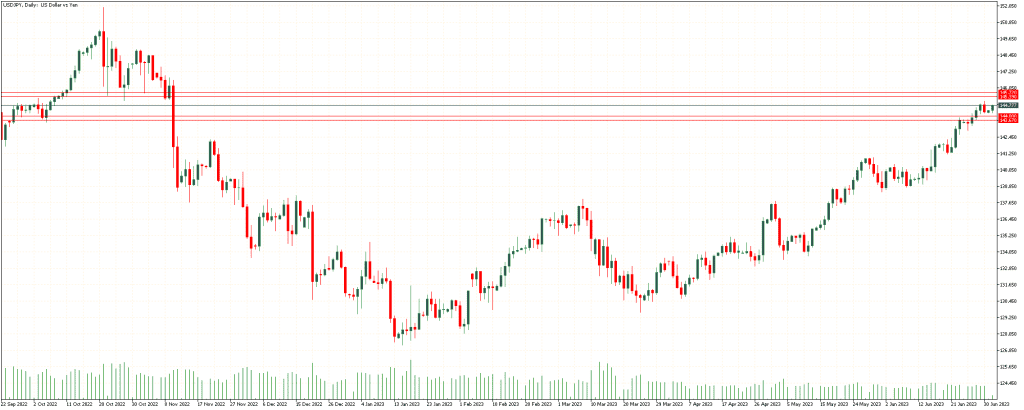

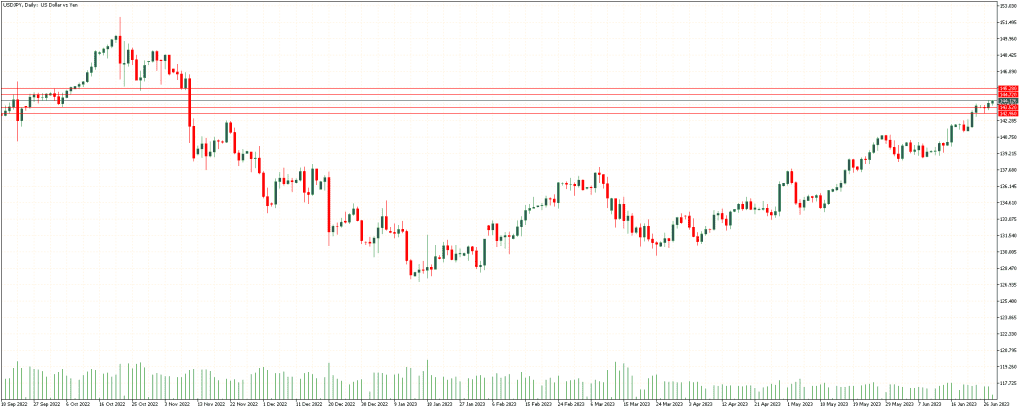

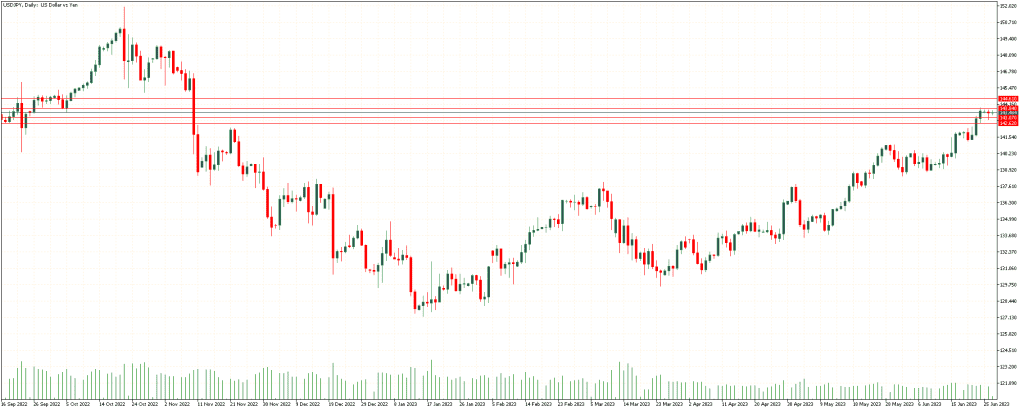

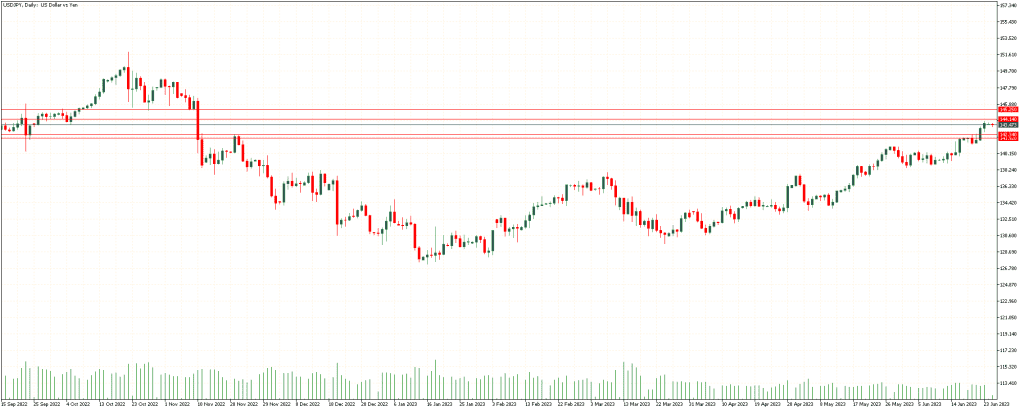

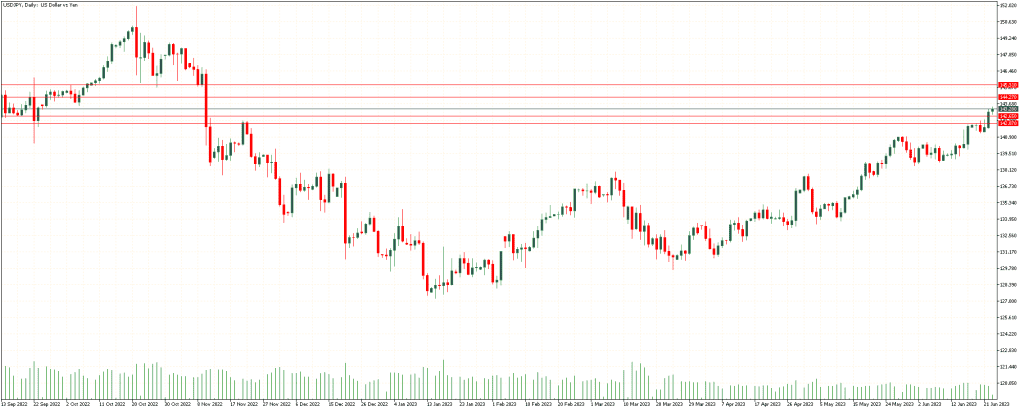

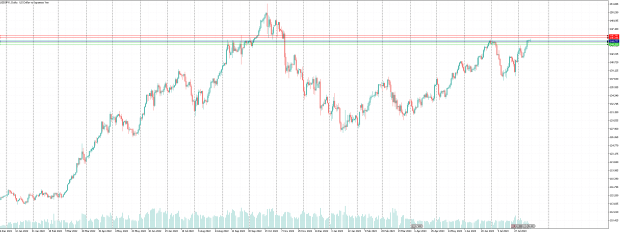

US Dollar – Japanese Yen

USD/JPY clings to mild losses around 145.50-45 heading into Tuesday’s European session as it prints the first daily loss in seven. The Yen pair takes clues from the upbeat Japanese statistics and the US Dollar’s retreat amid a sluggish Asian session.

If the pair continues to trade above the range of 145.220 It is likely to continue climbing to 146.147.

On the other hand, if the pair is traded below 145.220, it is expected to continue falling to 144.864.

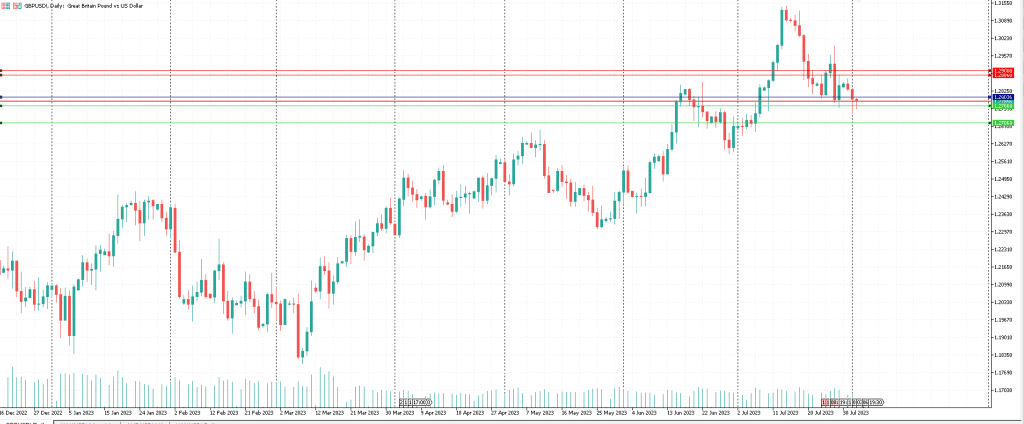

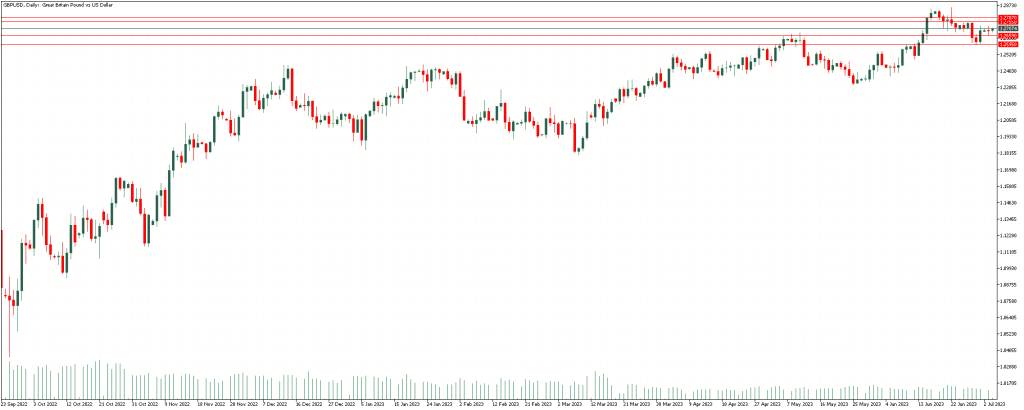

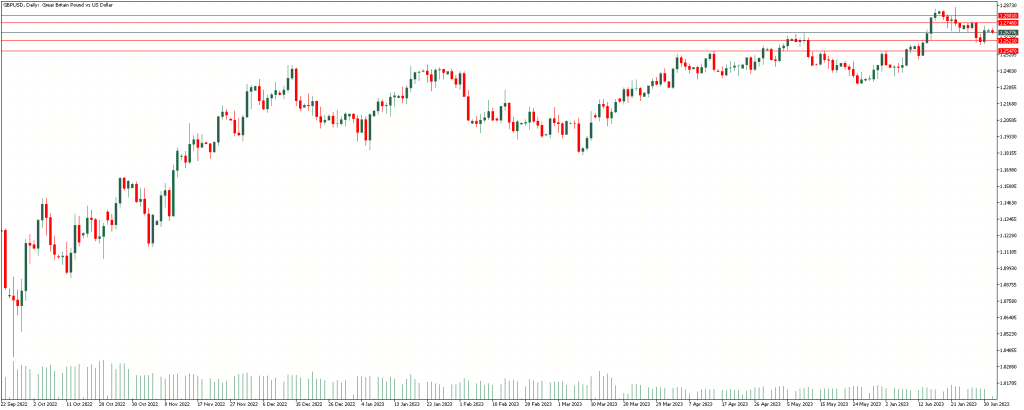

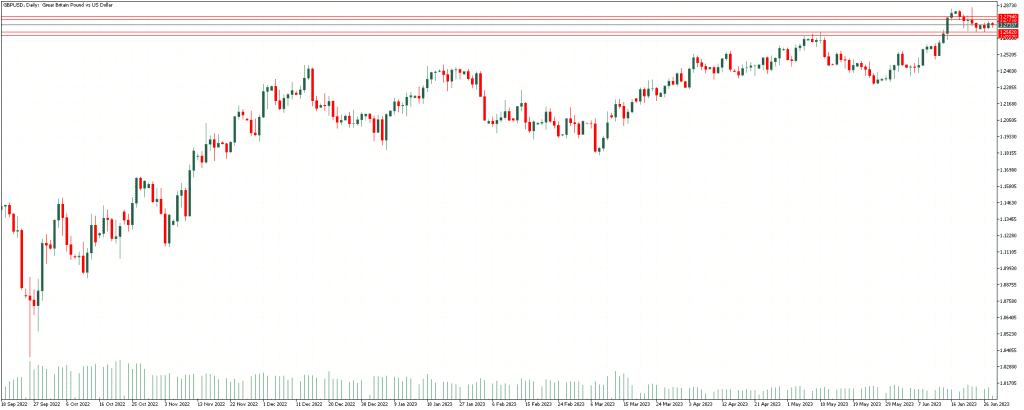

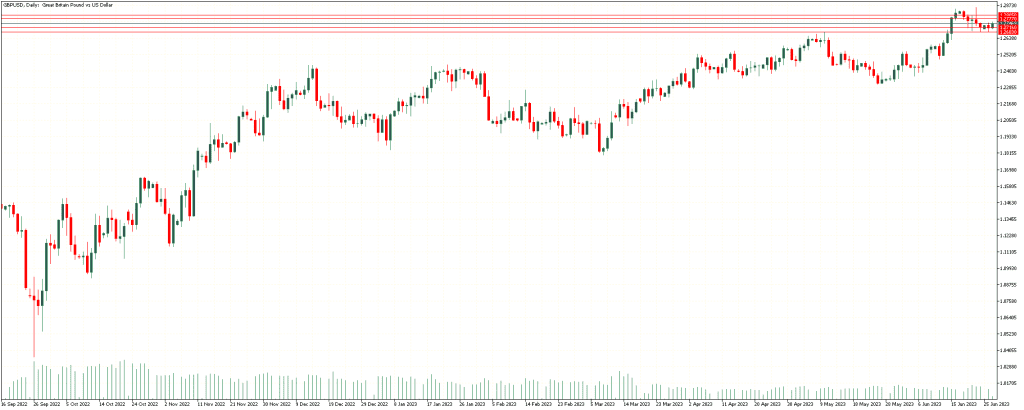

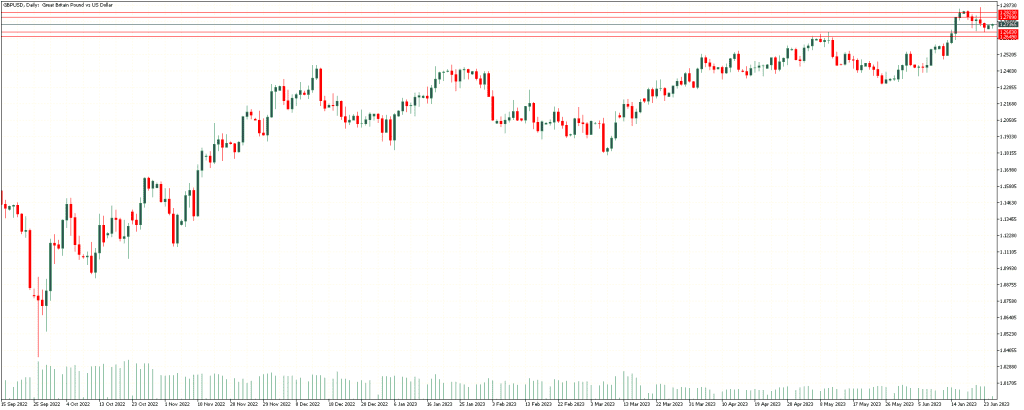

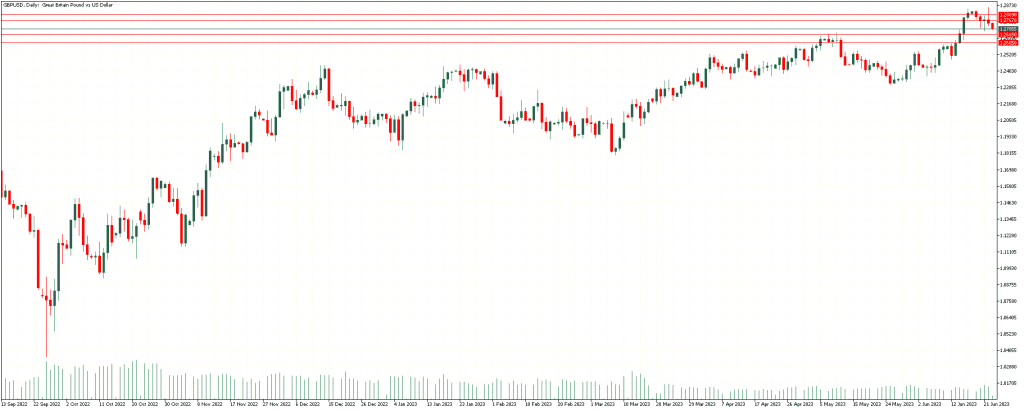

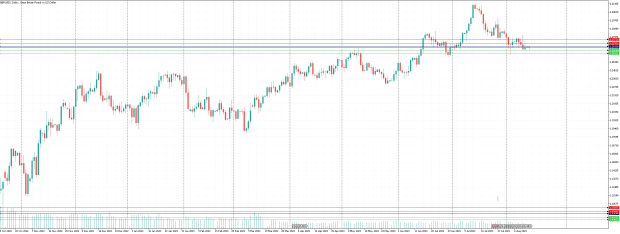

British Pound – US Dollar

GBP/USD traders modestly higher on the day above 1.2700 in the European morning. The data from the UK showed that the Unemployment Rate rose to 4.2% in three months through June but Pound Sterling managed to hold its ground amid strong wage inflation readings.

If the pair is trading above 1.26723 it is expected to climb to the range of 1.27707.

On the other hand, if the pair trades below 1.26723 it is expected to fall to the range 1.26298.

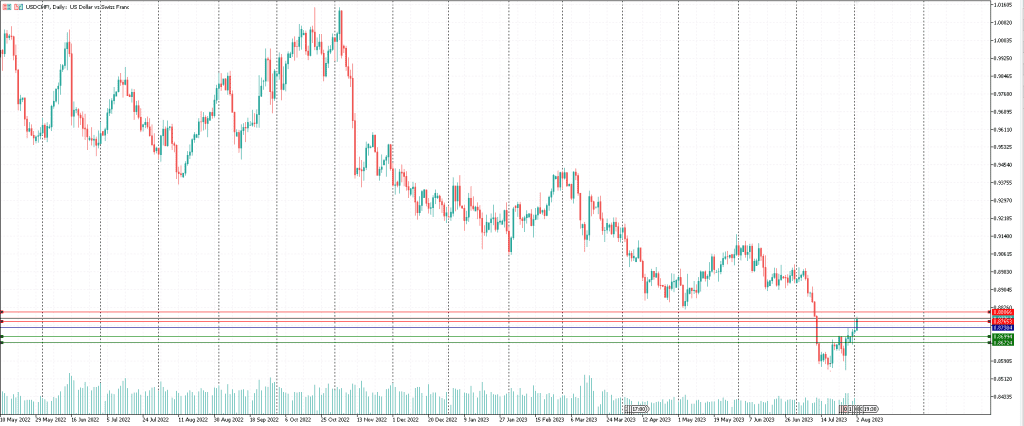

US Dollar – Swiss Franc

The USD/CHF pair holds ground around 0.8782 during the early Asian session on Tuesday. The pair remains sideways after retreating from a multi-week high of 0.8827.

If the pair is trading above 0.87587 it is expected to climb to the range of 0.88057.

On the other hand, if the pair trades below 0.87587 it is expected to fall to the range of 0.87368.

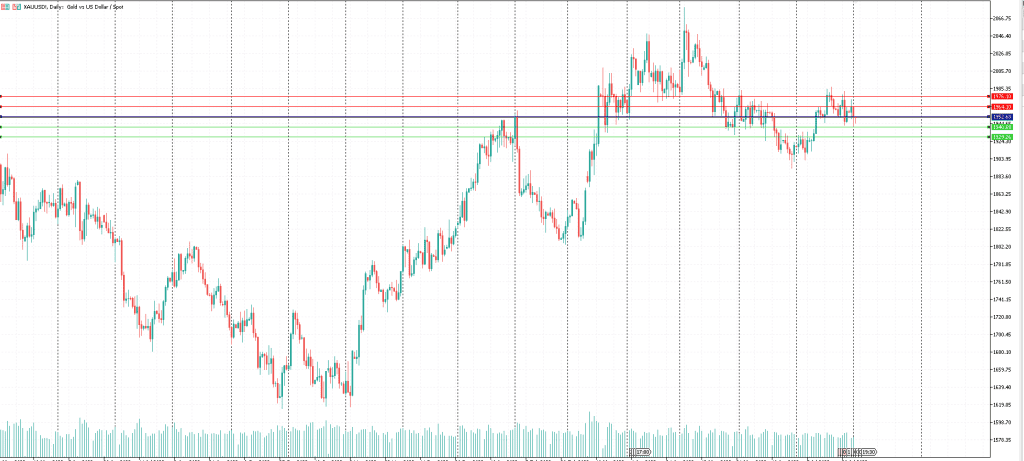

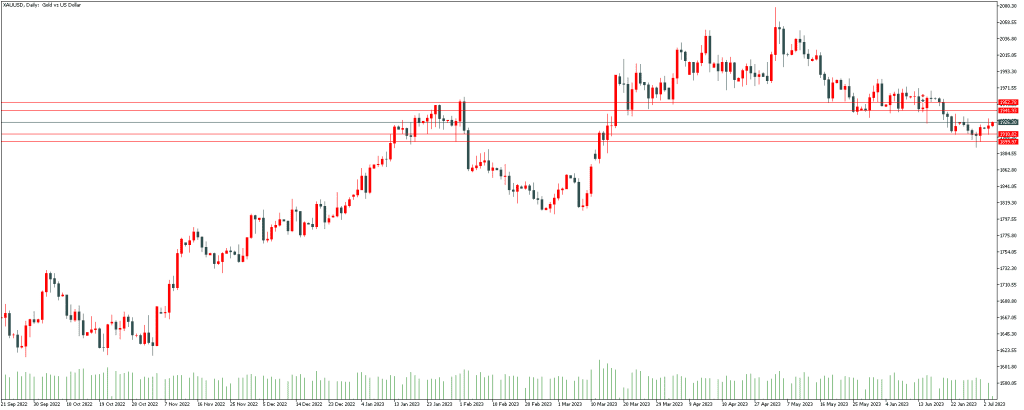

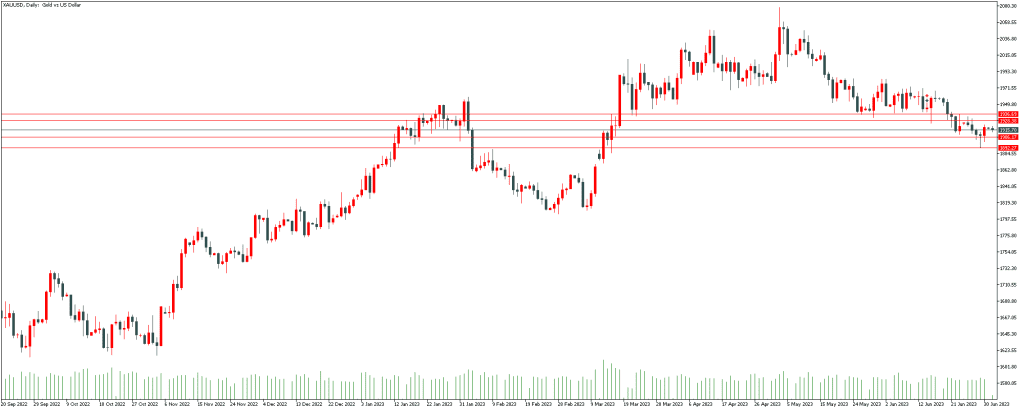

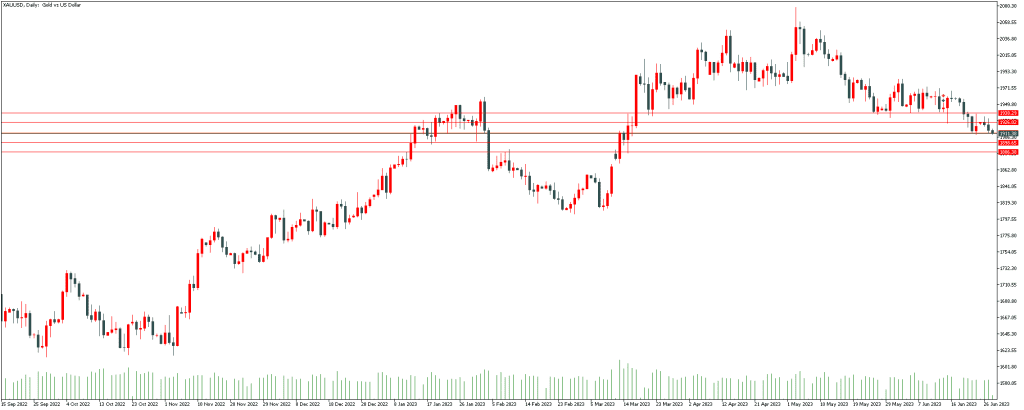

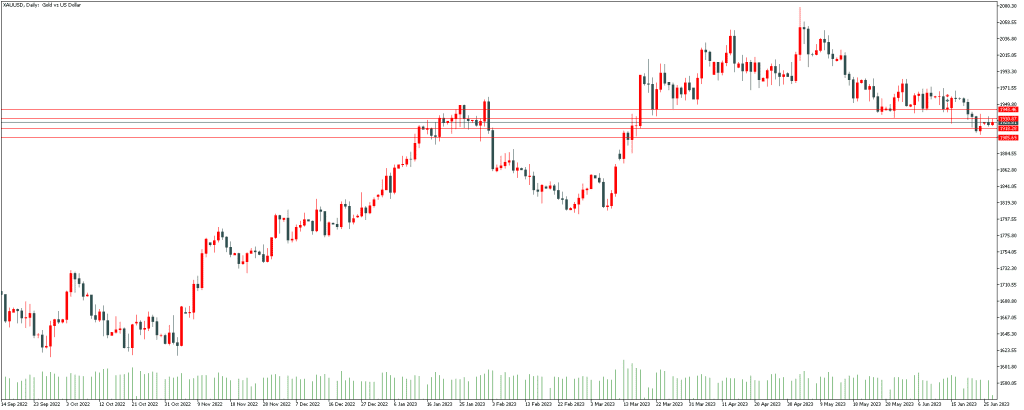

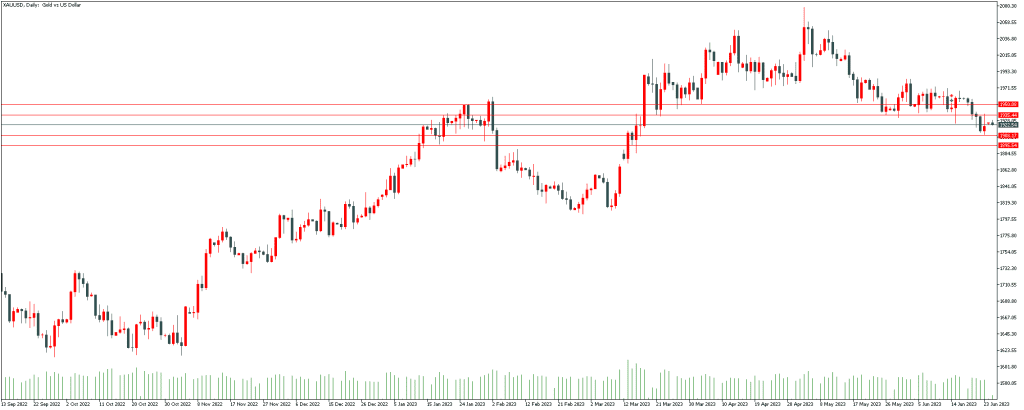

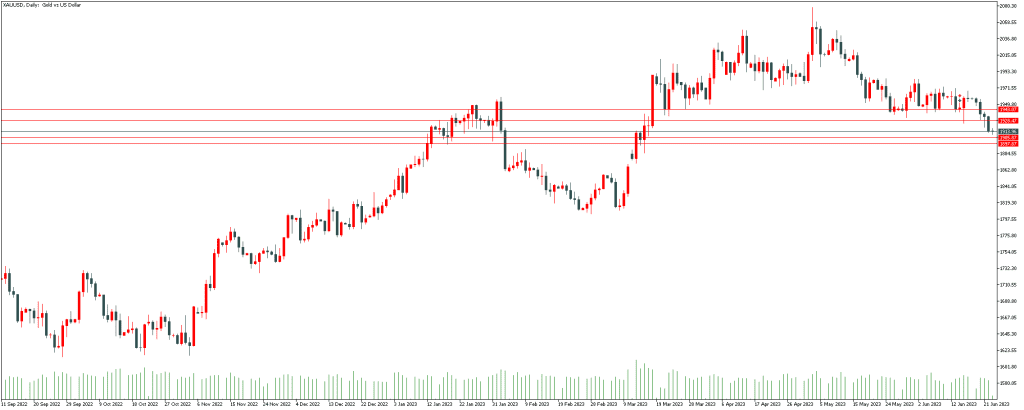

Gold – US Dollar

Gold price struggles to gain any meaningful traction on Tuesday and oscillates in a narrow trading band just above the $1,900 mark. The XAU/USD remains well within the striking distance of its lowest level since July 6 touched on Monday and seems vulnerable to prolonging its downward trajectory.

If the pair is trading above 1908.82 It is expected to climb to the 1914.95 range.

on the other hand, if the pair trades below 1908.82 It is expected to fall to the range of 1895.31.

USD/JPY holds lower grounds near 142.50, clings to mild losses amid early Friday morning in Europe after reversing from the highest level in a month the previous day. The Yen pair’s latest pullback could be linked to the market’s positioning for the US employment report for June, as well as a retreat of the US Treasury bond yields from a multi-day high marked the previous day. If the pair continues to trade above the range of 142.839 It is likely to continue climbing to 143.652. On the other hand, if the pair is traded below 142.839, it is expected to continue falling to 140.977.

USD/JPY holds lower grounds near 142.50, clings to mild losses amid early Friday morning in Europe after reversing from the highest level in a month the previous day. The Yen pair’s latest pullback could be linked to the market’s positioning for the US employment report for June, as well as a retreat of the US Treasury bond yields from a multi-day high marked the previous day. If the pair continues to trade above the range of 142.839 It is likely to continue climbing to 143.652. On the other hand, if the pair is traded below 142.839, it is expected to continue falling to 140.977.