Gold bulls seek acceptance from $1,935 and Fed Chair Powell …

EURUSD EUR/USD is moving back and forth around 1.0950 in the early European morning. The pair is struggling to find direction as investors are awaiting speeches from Fed Chair Powell and ECB President Lagarde for fresh guidance on interest rates. If the pair continues the uptrend to the range of 1.0991, it is expected to […]

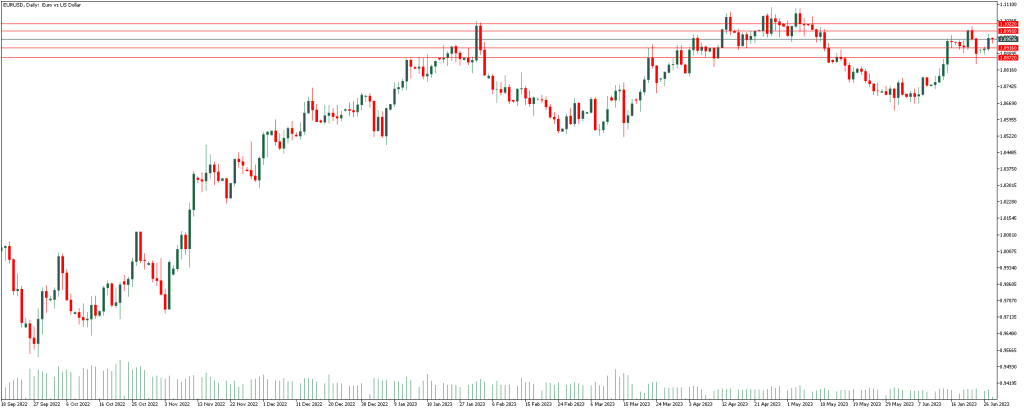

EURUSD

EUR/USD is moving back and forth around 1.0950 in the early European morning. The pair is struggling to find direction as investors are awaiting speeches from Fed Chair Powell and ECB President Lagarde for fresh guidance on interest rates.

If the pair continues the uptrend to the range of 1.0991, it is expected to continue the uptrend to the range of 1.1022.

On the other hand, If the pair continues the downtrend to the range of 1.0916, it is expected to continue the downtrend to the range of 1.0872.

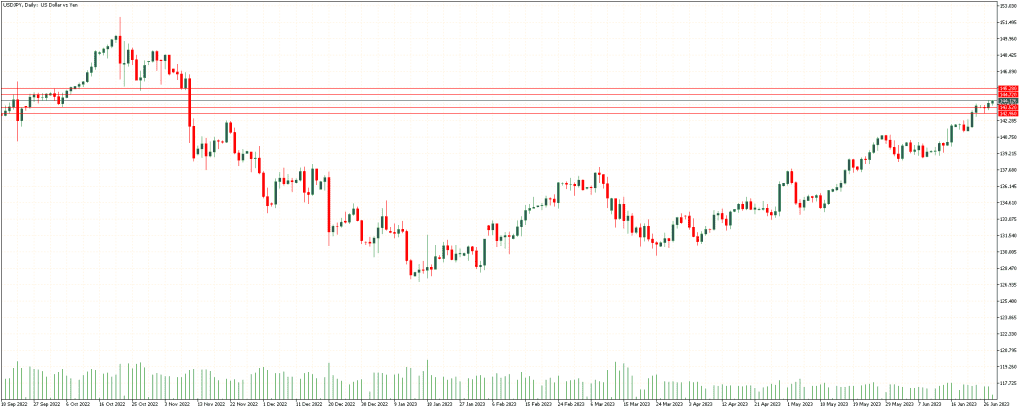

USDJPY

USD/JPY buyers lack upside momentum during early Wednesday as the Yen pair seesaws near 144.00, printing mild losses heading into the European session. The quote’s latest performance appears interesting as it stays within the weekly rising wedge bearish chart formation while making rounds to the highest levels since November 2022.

if the pair continues the uptrend to the range of 144.72, it is expected to continue the uptrend to the range of 145.28.

On the other hand, If the pair continues the downtrend to 143.52, it is expected to continue the downtrend to 142.96.

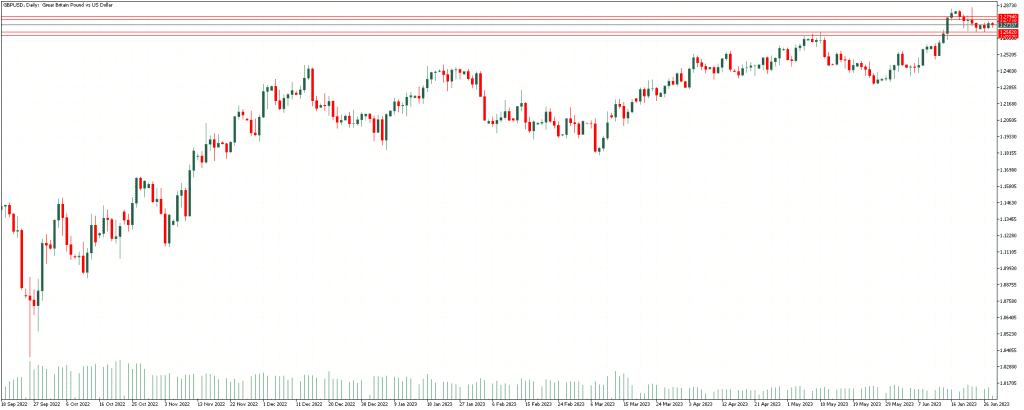

GBPUSD

If the pair continues the uptrend to the range of 1.2771, it is expected to continue the uptrend to the range of 1.2794.

On the other hand, if the pair continues the downtrend to 1.2682, it is expected to continue the downtrend to 1.2659.

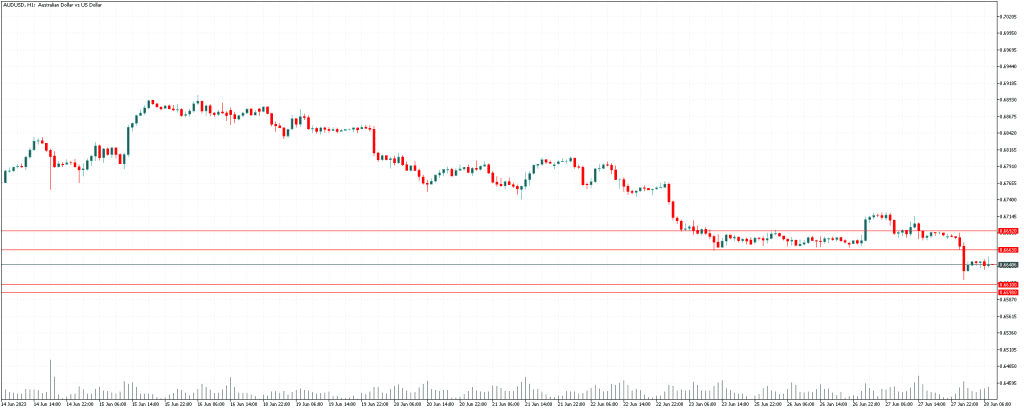

AUDUSD

AUD/USD is consolidating losses near 0.6650, having hit three-week lows after the Australian CPI rose 5.6% YoY in May vs. 6.1% expected. Softer-than-expected Australian inflation data fanned RBA rate hike pause bets. Focus shifts to Powell’s speech.

If the pair continues the uptrend to the range of 0.6663, it is expected to continue the uptrend to the range of 0.6692.

On the other hand, if the pair continues the downtrend to 0.6610, it is expected to continue the downtrend to 0.6598.

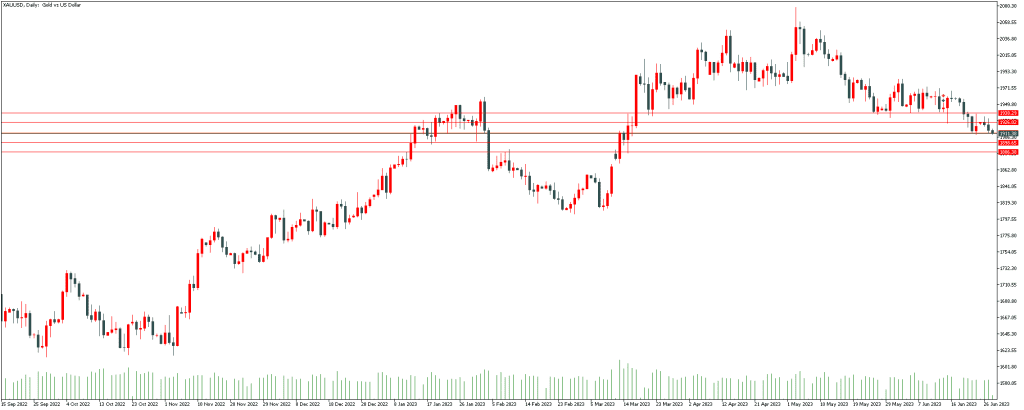

XAUUSD

Gold price stays defensive as traders struggle within jungle to technical levels ahead of key ECB Forum speeches. Upbeat US data, fears of Sino-American tussle prod XAU/USD bulls. Receding fears of recession in US, China allow Gold buyers to remain hopeful.

If the pair continues the uptrend to the range 1926.02, it is expected to continue the uptrend to the range of 1938.29.

On the other hand, if gold continues the downtrend to the range of 1898.65, it is expected to continue the downtrend to the range 1886.38.